The Reserve Bank of India has given some clear guidance on farm loans. If any bank branch insists on CIBIL, then action will be taken against it, warned CM Fadnavis during the 167th State Level Bankers’ Committee (SLBC) meeting held at Sahyadri Guest House.

Maharashtra Chief Minister Devendra Fadnavis has instructed banks in the state to disburse agricultural loans to farmers without asking for CIBIL scores. A CIBIL score is a credit worthiness mechanism of the Credit Information Bureau that financial institutions use to assess loan applications, focusing on the ability to repay.

“If farmers do not receive agricultural loans, it adversely affects the economy and increases farmer suicides. We have repeatedly instructed banks not to ask for CIBIL scores, yet they continue to do so. This must be resolved in today’s meeting itself. In the past, FIRs have been filed against such banks. This is a serious issue that banks must handle responsibly,” CM Fadnavis said.

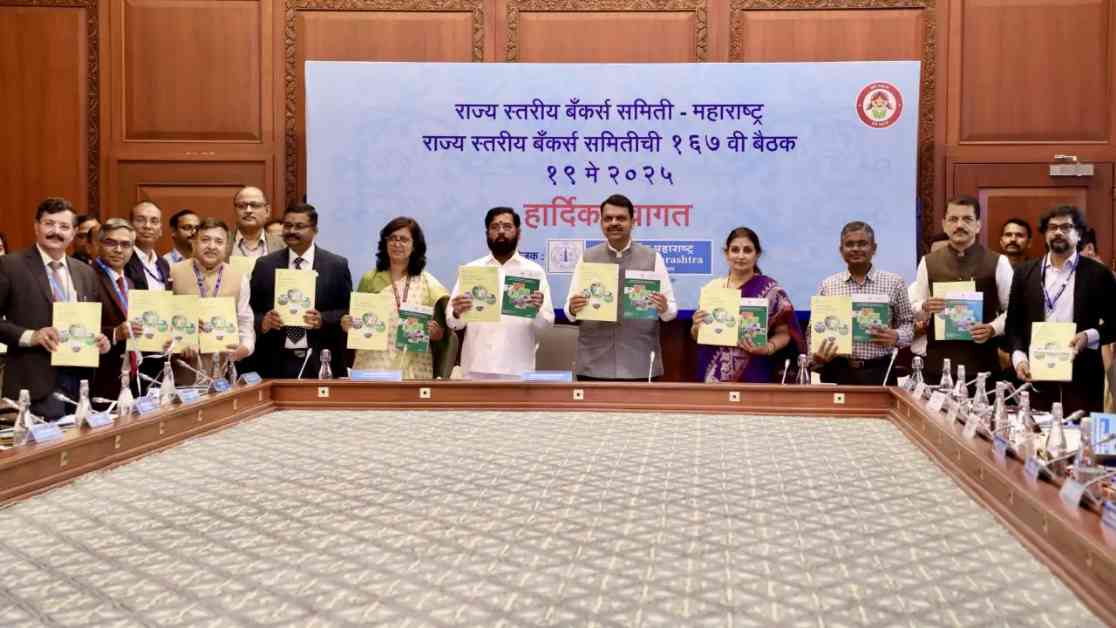

“The Reserve Bank of India has also issued clarity regarding farm loans. If any bank branch insists on CIBIL, then action will be taken against it,” warned CM Fadnavis during the 167th State Level Bankers’ Committee (SLBC) meeting held at Sahyadri Guest House.

Fadnavis directed nationalised banks to make special efforts to meet this year’s loan disbursement targets and expand agricultural credit coverage. A credit plan of Rs 44.76 lakh crore for Maharashtra for the financial year 2025-26 was approved during the meeting.

The CM emphasized Maharashtra’s leading position in the country, stating that farmers are the backbone of the state, and agriculture is a vital component of the economy. He stressed that neglecting agriculture is not acceptable and that nationalised banks must focus on increasing farm loan distribution.

With good rainfall predicted by the meteorological department, crops are expected to do well this year. In such a scenario, banks should extend greater support to farmers. Good rainfall boosts agricultural growth, benefiting both banks and farmers, according to CM Fadnavis.

Maharashtra is implementing an investment policy for agriculture, and banks should actively participate as they play a key role in the sector. An annual investment target of Rs 5,000 crore has been set for the sector, and banks will benefit by extending more credit to farmers.

Fadnavis highlighted Maharashtra’s achievement in crossing the USD half-trillion economy mark and progressing toward USD one trillion. He urged banks to play a key role in supporting the state’s status as the startup capital and in boosting the MSME sector.

Banks were also advised to prioritize tourism and service sectors. Fadnavis pointed out the significant presence of FPOs in Maharashtra and their role in agricultural development. He urged officials to focus on developing industrial networks in Maharashtra’s Gadchiroli district.

Banks aligning their priorities with the government’s objectives is crucial for holistic development. Implementing central and state government schemes is also the responsibility of banks, essential for achieving financial inclusion, as per CM Fadnavis.

Overall, the CM emphasized the importance of banks supporting various sectors of the economy to ensure the state and national economies’ strengthening.

Exciting news! Mid-day is now on WhatsApp Channels. Subscribe today and stay updated with the latest news!